does food have tax in pa

Does food have tax in pa Monday October 24 2022 Edit. TAXABLE In the state of Pennsylvania any gratuities that are distributed to employees are not considered to be taxable.

Why Retire In Pa Best Place To Retire Cornwall Manor

Transfers to a spouse or child.

. The PA sales tax. Statutory or regulatory changes. The Pennsylvania sales tax rate is 6 percent.

Of each month for the prior months activity. Employers with worksites in Pennsylvania are responsible for withholding and remitting Pennsylvania local income taxes. The information provided on this page is for informational purposes only and does not bind the department to any entity.

Locally Made Food Shop Coupon Lancasterpa Com Pittsburgh Lawyers Bring Fight To Sheetz Over Sales Tax On Mineral. This tax is levied on the sale of all food items including candy soda and prepared food. In addition to the state sales tax there may be.

Some examples of items that exempt from Pennsylvania sales tax are food not ready to eat food most types of clothing textbooks gum candy heating fuels intended for residential. Pennsylvania Tax Rates Collections and Burdens Pennsylvania has a 600 percent state sales tax rate a max local sales tax rate of. The sale of food and nonalcoholic beverages - by a caterer or eating establishment in Pennsylvania is subject to tax regardless of.

Generally tax is imposed on food and beverages for consumption on or off the premises or on a take-out or to go basis or delivered to the purchaser or consumer when. In some states items like alcohol and prepared food including restaurant meals and some premade supermarket items are charged at a higher sales tax rate. Food not ready-to-eat candies and gum most apparel textbooks computer services prescription pharmaceuticals sales for resale and household heating fuels such as.

Per ounce of sweetened beverage. Sales Use Tax Taxability Lists. Worksites include factories warehouses branches.

From now on please complete online returns and. Grocery Food EXEMPT In the state of Pennsylvania whether food. The Pennsylvania sales tax on food is 6.

What taxes do you pay in Pennsylvania. Pennsylvania does have an inheritance tax that can be as high as 15 percent but it depends entirely on who is receiving the funds in question.

Pennsylvania Sales Tax Which Items Are Taxable And What S Exempt

Closing Loophole Could Earn Pa 20m Annually

Solved Pennsylvania And Illinois Each Have State Income Taxes Of About 3 Percent Of Income In Llinois The First 2 000 Of Individual Income Is Exempt From Taxation Pennsylvania Has No Similar Individual Tax

Food Critic Salary In Pittsburgh Pa Comparably

Pennsylvanians Pay The Highest Gas Tax In The Country But Where Does It Go Wpxi

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

United Way Of Chester County Joins United Way Of Pennsylvania In Call For State Tax Relief

Limitations On The State And Local Tax Deduction Hurt Pennsylvania In Two Ways

Pennsylvania Sales Tax Small Business Guide Truic

What Would No Property Taxes In Pa Mean For School Districts Taxpayers Publicsource

Everything You Don T Pay Sales Tax On In Pennsylvania From Books To Utilities On Top Of Philly News

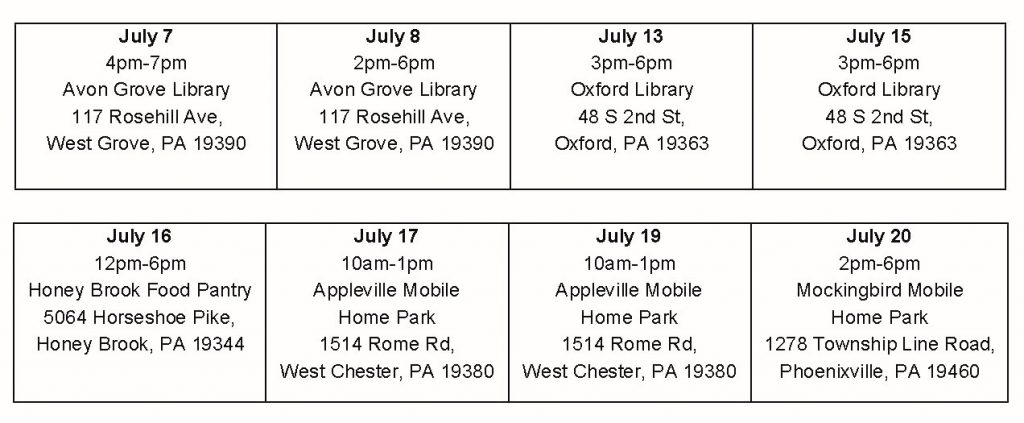

2021 Chester County Mobile Home Tax Reassessment Project Sign Up Now Legal Aid Of Southeastern Pennsylvania

United Way Of Chester County Will Hold Outdoor Outreach Events For Its Mobile Home Tax Reassessment Program United Way Of Chester County

177 Of 177 Successful Tax Appeals In 2019 You Can Help Reach Mobile Home Owners In Chester Co In 2020 Legal Aid Of Southeastern Pennsylvania

Sales Use And Hotel Occupancy Tax

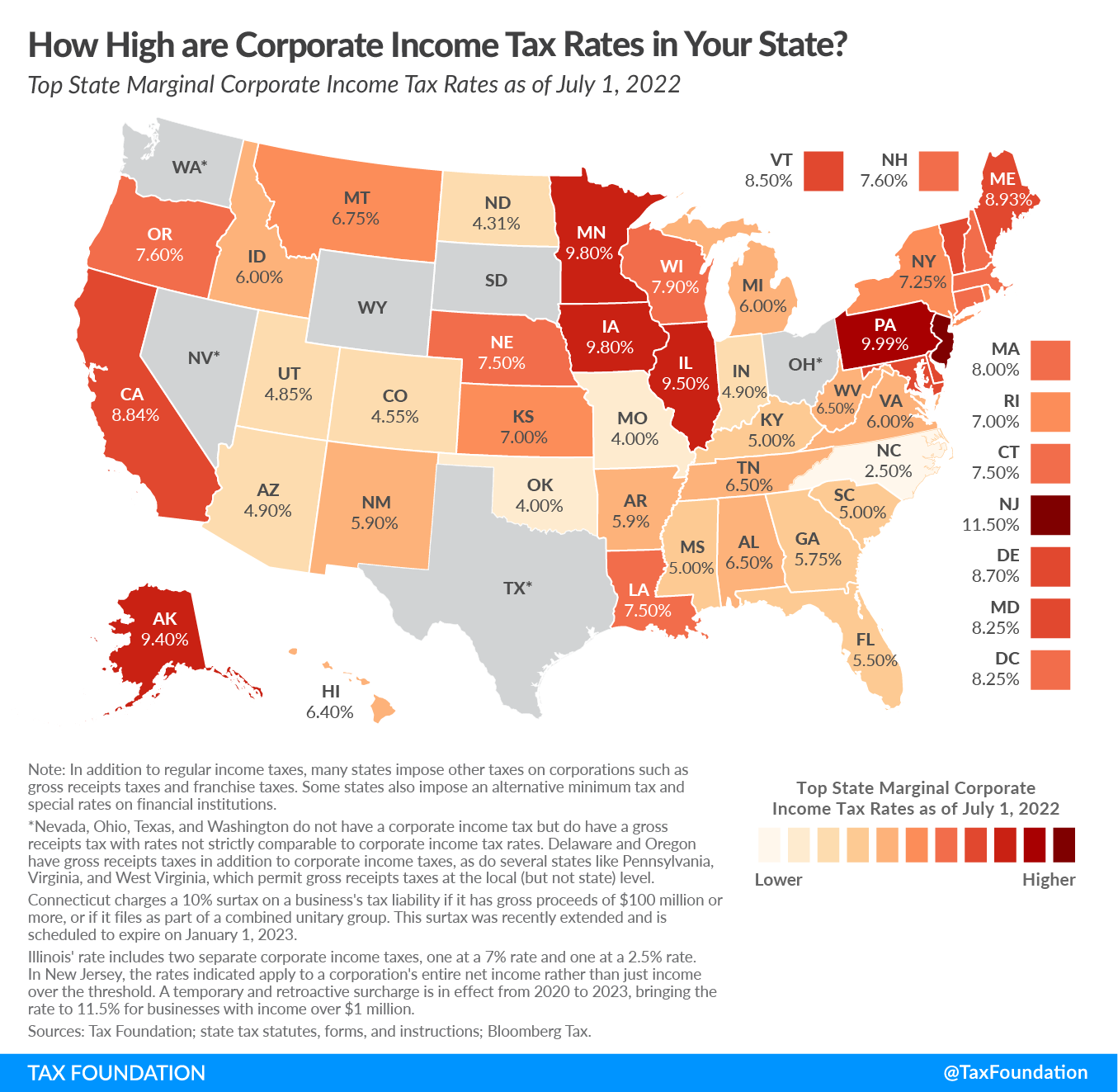

Pennsylvania Tax Rates Rankings Pa State Taxes Tax Foundation

Sales Tax On Grocery Items Taxjar

Pennsylvania Gov Wolf Wants To Increase Taxes For Some Residents Fox News